Publications | Dennis Shen

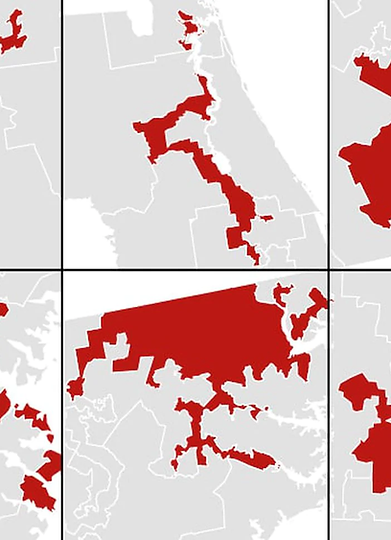

Image source: Washington Post at https://www.washingtonpost.com/news/wonk/wp/2014/05/15/americas-most-gerrymandered-congressional-districts/

Publications: Dennis Shen

RESEARCH for SCOPE GROUP

RESEARCH PUBLICATIONS:

-

'Global Economic Outlook 2026: Increasing financial system risk; trade, sovereign debt and geopolitical uncertainties underscore negative global macro and credit outlook', 8 December 2025.

-

'Global Economic Outlook Mid-Year 2025: Trade, geopolitical and sovereign-debt risks, alongside sustained high rates, weigh on the macro-economic outlook', 20 June 2025.

-

'Global economic outlook: Soft economic landing but elevated steady-state rates underscore balanced economic risk for the global economy', 1 October 2024.

-

'G7: rising debt heightens sovereign risks: Rising debt-to-GDP trajectories combine with higher-for-longer interest rates', 4 July 2024.

-

'Why Morocco is emerging stronger than South Africa from recent crises: Growth, reform help explain divergent rating trajectories', co-authored, 24 January 2024.

-

'Sovereign Outlook 2024: Soft economic landing and turn of the global rate cycle balance fiscal and geopolitical risks for sovereigns', co-authored, 15 December 2023.

-

'Sovereign Mid-Year 2023 Outlook: Economic slowdown, challenging fiscal dynamics and high interest rates underpin negative outlook for sovereign ratings', co-authored, 18 July 2023.

-

'Debt-ceiling crisis a core risk to credit ratings of US government', 17 February 2023.

-

'Central and Eastern Europe Sovereign Outlook 2023: Growth falters amid war, higher cost of debt, energy security risk', co-authored, 15 December 2022.

-

'Sovereign Outlook 2023: Sharp economic slowdown, challenging fiscal dynamics, high inflation and rising rates underpin divergence in sovereign ratings', co-authored, 12 December 2022.

-

'July 2022 Central and Eastern Europe Mid-Year Sovereign Outlook', co-authored, 26 July 2022.

-

'July 2022 Sovereign Mid-Year Outlook: Recovery slowdown, high inflation and rising rates present divergence in sovereign ratings and outlooks', co-authored, 18 July 2022.

-

'2022 Central and Eastern Europe Sovereign Outlook: Sound albeit uneven growth ahead but risks to the region are mounting', co-authored, December 14, 2021.

-

'2022 Sovereign Outlook: An uneven global recovery amid Covid-19, inflation and monetary tightening challenges sovereign outlook', co-authored, December 7, 2021.

-

'2021 External Vulnerability and Resilience rankings: Risks for emerging economies amid rising inflation, rates', co-authored, November 8, 2021.

-

'June 2021 Central and Eastern Europe Interim Sovereign Outlook: Sustained recovery to pre-crisis levels by 2022, but at varying speeds', co-authored, June 30, 2021.

-

'June 2021 Interim Sovereign Outlook: A robust yet uneven global recovery continues, with diverging sovereign ratings implications', co-authored, June 17, 2021.

-

'Nordic sovereigns: strong environmental policies support high credit ratings', co-authored, May 17, 2021.

-

'Brexit trade agreement avoids no-deal, but disruptions and persistent uncertainty weaken UK outlook', January 7, 2021.

-

'2021 Central and Eastern Europe Sovereign Outlook: The region’s economic recovery anchored by monetary, fiscal stimulus, but rising debt, external risks are concerns in some countries', co-authored, December 17, 2020.

-

'2021 Sovereign Outlook: Recovery at last, with monetary and fiscal frameworks in transition, and diverging sovereign rating implications', co-authored, December 9, 2020.

-

'Africa’s solvency crisis: China’s participation in G20 debt relief a sign of multilateralism, but a “DSSI+” framework is required', co-authored, November 16, 2020.

-

'Q4 2020 Central and Eastern Europe (CEE) Sovereign Update: CEE recovery from the Covid-19 crisis to be gradual and uneven amid significant virus resurgence in Q4', co-authored, October 19, 2020.

-

'Q4 2020 Sovereign Update: A gradual and uneven global recovery faces challenges in Q4 2020 and 2021, with diverging sovereign ratings implications', co-authored, October 12, 2020.

-

'African fiscal vulnerabilities, effects of 2020 global support initiatives and impact on sovereign creditworthiness', co-authored, September 3, 2020.

-

'Q3 2020 Central and Eastern Europe (CEE) Sovereign Update: Rebound has begun, but full recovery only after 2021', co-authored, July 15, 2020.

-

'Q3 2020 Sovereign Update: Covid-19 pandemic’s economic impact: gradual and uneven global recovery with significant risks still on the horizon', co-authored, July 8, 2020.

-

'Nordic economies: Covid-19 impairs 2020 growth but public debt levels manageable', co-authored, June 25, 2020.

-

'Italy: debt sustainability hinges on ECB policy as Covid-19 crisis results in rise in debt and funding needs', co-authored, May 8, 2020.

-

'Five charts to explain Turkey’s major external sector vulnerabilities in 2020', co-authored, May 5, 2020.

-

'Q2 2020 Central and Eastern Europe (CEE) Sovereign Update', co-authored, April 27, 2020.

-

'2020 External Vulnerability and Resilience rankings for 63 countries: Covid-19 Crisis update', co-authored, April 21, 2020.

-

'Q2 2020 Sovereign Update: Covid-19 pandemic’s economic impact: significant risk as the world economy falls into recession', co-authored, April 3, 2020.

-

'Special Comment: Covid-19 Risks and Impact on the 2020 Global Outlook', March 13, 2020.

-

'EU fiscal risk assessment: Italy, Spain, Greece rank among most fragile; Belgium, France vulnerable', co-authored, February 7, 2020.

-

'Italy revisits fiscal reform: the tax-wedge challenge in five charts', co-authored, January 9, 2020.

-

'CEE 2020 Sovereign Outlook: subdued regional growth trends amid greater economic resilience', co-authored with the Scope Public Finance team, December 10, 2019.

-

'Sovereign Outlook 2020: slow growth, political uncertainty, rising debt add pressure on policymakers', co-authored with the Scope Public Finance team, December 2, 2019.

-

'Q4 sovereign update: amid weak growth, policy focus shifts from central banks to governments', co-authored with the Scope Public Finance team, October 1, 2019.

-

'Q3 sovereign update: monetary easing supports growth outlook, challenged by fiscal, trade policy', co-authored with the Scope Public Finance team, July 1, 2019.

-

'Q2 Sovereign Update: Slower growth, political uncertainty mitigated by easier monetary policy', co-authored with the Scope Public Finance team, April 4, 2019.

-

'Brexit: Uncertainty weighs on UK ratings, while risks to Ireland’s and the EU’s ratings more limited', co-authored, March 15, 2019.

-

'Brexit Outlook: Chronic uncertainty to endure as UK teeters between soft Brexit and no Brexit', January 8, 2019.

-

'External risk and trade wars: Scope presents dual frameworks to capture sovereign external risks', co-authored, December 13, 2018.

-

'Sovereign Outlook 2019: Multiple stress factors set to weigh on growth and sovereign risk', co-authored with the Scope Public Finance team, November 29, 2018.

-

'Q4 Sovereign Update: Three populist threats aggravating downside risks to outlook', co-authored with the Scope Public Finance team, October 8, 2018.

-

'Scope expects UK to avoid no-deal Brexit, but high economic uncertainty underscores Negative Outlook', August 27, 2018.

-

'Quarterly Update: Outlook for euro area remains constructive, despite growing protectionism risk', co-authored with the Scope Public Finance team, July 2, 2018.

-

'Risks abound for the overheated Nordic housing market, but no crisis', co-authored, April 26, 2018.

-

'Quarterly Update: Five Risks to the European and Global Outlook', co-authored with the Scope Public Finance team, April 12, 2018.

-

'Scope welcomes European Commission’s Action Plan on sustainable finance', co-authored, March 22, 2018.

-

'Prolonged Brexit uncertainty leaves the UK facing more sluggish economic growth', March 20, 2018.

-

'Election Risk to Reforms Clouds Italian Sovereign Outlook', co-authored, February 5, 2018.

-

'Four reasons why Russia is investment grade and Turkey is not', co-authored, January 19, 2018.

-

'Special comment: Risks to Brexit trade talks pronounced as UK, EU approach next phase', December 15, 2017.

-

'Public Finance Outlook 2018: Europe is resilient but global risks are rising', co-authored with the Scope Public Finance team, November 23, 2017.

-

'Special comment: China’s sovereign ratings hinge on deleveraging initiatives', November 15, 2017.

-

'Special comment: Catalonia to remain in Spain despite referendum, but tensions escalate', co-authored, October 6, 2017.

-

'Special comment: Merkel’s government to push ahead, despite weakened authority', co-authored, September 27, 2017.

-

'Special comment – German elections: low risk event but important for reform prospects in Europe', co-authored, September 12, 2017.

-

'Special comment: Uncertainties around Brexit challenge UK credit outlook', co-authored, August 24, 2017.

For additional research with the rating agency, such as commentaries and rating announcements I have worked on, please see Scope site.

LSE and ECPR ARTICLES

BLOGS:

-

'A just peace settlement for Ukraine remains elusive', European Consortium for Political Research's The Loop, January 13, 2026.

-

'Activating frozen Russian assets is the only viable option for continuing to fund Ukraine', LSE European Politics and Policy, October 20, 2025.

-

'The easing of fiscal rules raises long-term economic risks', LSE British Politics and Policy, November 15, 2024.

-

'Georgian election results may challenge nation’s socio-political stability', European Consortium for Political Research's The Loop, October 29, 2024.

-

'Africa needs innovative debt-relief solutions to avoid a lost decade', Africa at LSE Blog, August 6, 2024.

-

'For the US government, debt-ceiling crises are both costly and avoidable.' LSE US Politics and Policy, March 16, 2023.

-

'How rating agencies could support African governments in overcoming debt crises', co-authored, Africa at LSE Blog, July 4, 2022.

-

'Brexit remains far from over: the “slow burn” of EU-exit will stress the British economy long term', LSE Brexit Blog, January 19, 2021.

-

'Why Isn’t There More Alarm About the Gerrymandering of US Presidencies?', LSE School of Public Policy Blog, November 29, 2019.

-

'Outlook for Italy: Fiscal policy and instability in the government remain key sources of risk', LSE European Politics and Policy, June 27, 2019.

-

'29 March: Brexit in name only or an Article 50 extension are on the cards', LSE Brexit Blog, January 11, 2019.

-

'Ultimately, public opinion is unlikely to tolerate a hard Brexit', LSE Brexit Blog, December 5, 2017.

-

'A rise in narcissism could be one of the main causes of America’s political and economic crises', LSE US Politics and Policy (reposted on Newsweek; cited by RealClearScience), June 28, 2017.

-

'The Only Way to Halt the Rise of Demagoguery May Be to Reform Globalization', LSE US Politics and Policy, February 16, 2017.

-

'Central Banks Are Facing a Crisis of Confidence – It’s Time to Reinvent Global Monetary Policy', LSE European Politics and Policy (reposted on the Global Policy Journal Blog), October 6, 2016.

-

'Recap: Why Brexit Still Faces Extraordinary Challenges', LSE British Politics and Policy, September 12, 2016.

-

'Europe’s Recent Attacks Underline the Need for a New Strategy to Combat Terrorism', LSE European Politics and Policy, July 26, 2016.

-

'The Cost of Wealth Inequality in Higher Education', LSE British Politics and Policy, September 9, 2013.

-

'Book Review: Intelligent Governance for the 21st Century', LSE Review of Books, March 9, 2013.

JOURNAL PUBLICATIONS:

-

'Capitalism, Corporatocracy and Financialization: Imbalances in the American Political Economy', The Public Sphere Journal, Fall 2012 Issue.

DENNIS' ALLIANCEBERNSTEIN RESEARCH

WHITE PAPERS:

-

'Dynamic Fiscal Multipliers: Why Austerity Has Failed in the Euro Area', with Darren Williams, Alliance Bernstein White Paper, March 20, 2013.

-

'When “Risk-Free” Isn’t Risk Free: The Impact of a US Treasury Downgrade', with Ivan Rudolph-Shabinsky, Alliance Bernstein White Paper, June 7, 2011.

-

'Policymakers Need Broader Framework to Evaluate Prices and Prevent Bubbles', with Joseph Carson, Alliance Bernstein Economic Perspectives: US, December 11, 2009.

SELECT ECONOMIC PERIODICALS (co-authored alongside Darren Williams):

-

'Greek Negotiations Continue Amid Cash Crunch', Alliance Bernstein Economic Perspectives: Europe, April 10, 2015.

-

'A Constructive Outlook on Spain', Alliance Bernstein Economic Perspectives: Europe, March 6, 2015.

-

'Rocky Road Ahead for Greece’s New Government', Alliance Bernstein Economic Perspectives: Europe, February 6, 2015.

-

'Greek Risk Rises as Election Looms', Alliance Bernstein Economic Perspectives: Europe, January 9, 2015.

-

'Structural Reforms: A Key Missing Link in the Euro Area', AB Economic Perspectives: Europe, November 21, 2014.

-

'Early Exit and Elections in Greece?', Alliance Bernstein Economic Perspectives: Europe, October 17, 2014.

-

'A Reversal in Euro Area Rebalancing', Alliance Bernstein Economic Perspectives: Europe, September 19, 2014.

-

'Portugal Can Surmount Espírito Santo Crisis', Alliance Bernstein Economic Perspectives: Europe, August 8, 2014.

-

'Europe’s Fiscal Progress Faces Complacency Risk', AB Economic Perspectives: Europe, June 20, 2014.

-

'EU Elections: Radical Parties to Make Loud Headlines, Limited Impact', AB Economic: Europe, May 23, 2014.

-

'Will Belgium Avoid Post-Election Deadlock?', Alliance Bernstein Economic Perspectives: Europe, May 9, 2014.

-

'Can Greece Exit Its Bailout?', Alliance Bernstein Economic Perspectives: Europe, April 11, 2014.

-

'The Road to Portugal’s Bailout Exit', Alliance Bernstein Economic Perspectives: Europe, March 28, 2014.

-

'Gauging Political Threats to Greece’s Recovery', AB Economic Perspectives: Europe, February 28, 2014.

-

'Ireland’s Bailout Exit: Hope or False Precedent', Alliance Bernstein Economic Perspectives: Europe, November 22, 2013.

-

'Portugal: The Politics of Austerity', Alliance Bernstein Economic Perspectives: Europe, October 11, 2013.

-

'Spain: A Recovery with Bumps Along the Way', Alliance Bernstein Economic Perspectives: Europe, September 20, 2013.

BLOGS:

-

'Clock Will Be Ticking for Greece’s New Government', with Darren Williams, AB Blog, January 15, 2015.

-

'European QE Draws Attention to Irish Bonds', with John Taylor, AB Blog, December 17, 2014.

-

'Will New Greek Drama Threaten European Periphery?', with Darren Williams, AB Blog, October 20, 2014.

-

'New Dawn for Peripheral Europe?', with Darren Williams, AB Blog, May 7, 2014.